GOVT TO PROVIDE 50% SUBSIDY ON SOLAR ROOFTOP INSTALLATION

The State Government offers 50 per cent subsidy for installation of solar rooftops in households and 10 per cent subsidy to industry.

Arvind Kumar, Project Director, Jharkhand Renewable Energy Development Authority ( JREDA) announced that the State Government is keen to provide subsidy to encourage the installation of solar roof tops for consumers , households and also for industries.

Kumar was addressing the second Green Conclave 2017—Think Renewal, The Smart Alternative organised by the Confederation of Indian Industry (CII) at Beldih Club.

He said that JREDA is actively working on creating awareness about the use of solar, wind, bio gas and biomass-based various technologies amongst public, and also to promote the policies and programmes necessary for popularising the applications of various new and renewable energy technologies in the State.

Neeraj Kant, chairman CII Jamshedpur Zonal Council in his opening remarks mentioned that renewable energy sources and technologies have potential to provide solutions to the long-standing energy problems being faced by the country. He added that, today renewable account for about 33 per cent of India's primary energy consumptions. India is increasingly adopting responsible renewable energy techniques and taking positive steps towards carbon emissions, cleaning the air and ensuring a more sustainable future. He also mentioned that the Government is playing an active role in promoting the adoption of renewable energy resources by offering a host of incentives to the industry.

Shubhenjit Chaudhuri, convener of Mining, Environment & Sustainability Panel, CII Jharkhand highlighted the need for industries to go green.

He also mentioned that the use of renewables is their prime choice for enhancing access to affordable, reliable and cleaner sources of modern energy services. More than 170 countries have established renewable energy targets, and nearly 150 have enacted policies to catalyse investments in renewable energy technologies. Many are looking to partner with an increasingly active private sector. He also highlighted that renewable energy sources and technologies have potential to provide solutions to the long-standing energy problems being faced by India. He further added that the renewable energy sources like wind energy, solar energy, geothermal energy, ocean energy, biomass energy and fuel cell technology can be used to overcome energy shortage in India.

Ashish Mathur, managing director, Jusco, highlighted that the need for promoting the use of renewable sources is now. He also mentioned that Jusco is actively working on effectively utilising solar energy for town electrification.

He also added that Jamshedpur will have the privilege of being one of the first zero discharge cities in the country.

Solar energy reaches another milestone

CHENNAI, MARCH 30:

Figures released by the Central Electricity Authority today show that the Indian solar energy sector crossed a milestone in January – generating over 10 billion units of electricity for the first time.

In the April 2016-Januray 2017 period, solar power plants in India generated more than 10,565 million kWhr of electricity—roughly twice (5,726 million kWhr) as much as it did in the corresponding period of last year, albeit on a higher installed capacity base.

It is pertinent to mention that the installed capacity of solar also crossed the 10,000 MW mark in January, and amounted to a fifth of the total renewable energy capacity in India, which, incidentally, also crossed the milestone of 50,000 MW in January.

But in the context of overall power generation in the country, which amounted to 1,038 billion kWhr in April ’16 – January ’17, solar’s contribution was just a little above one per cent.

Wind power sector, which has 30,000 MW of capacity standing on Indian soil, produced 41,159 million units.

On the overall, the renewable energy sector, comprising mainly wind and solar but also a little of small hydro and biomass, generated 70 billion units of electricity—contributing 7 per cent to the country’s total generation. Electricity generation from this sector grew 26.31 per cent, compared with the first ten months of last year.

Thermal power continues to dominate the country’s energy sector, growing 31 per cent in terms of generation (968 billion units.)

India has total electricity generation capacity of 315,426 MW, of which 189,048 MW is coal-fired. Another 25,329 MW of natural gas fired plants also come under ‘thermal’. Hydro capacity of 44,413 MW and nuclear of 5,780 MW come only after renewable energy’s 50,018 MW.

It is also noteworthy that the 12th Plan target for power capacity addition of 88,537 MW has already been met—achievement in the Plan period, which ends this month, stood in January at 94

Economic Survey of Power Sector - A Short Review:

The Economic Survey notes that sweeping changes have been made in the power sector in the last two years. 2014-15 witnessed the highest ever increase in generation capacity of 26.5 GW compared to the average annual addition of around 19 GW over the past five years. Capacity enhancements have brought down the peak electricity defecit to its lowest ever level of 2.4%.

Central and state governments have come together to address problems related to the health of distribution companies and the debt overhang problem via the Ujwal DISCOM Assurance Yojna (UDAY).

The Survey states that renewable energy targets have been revised from 32 GW to 175 GW to give a policy push to the renewable sector and sustainable development. Grid parity for solar generation is on its way to becoming a reality with auctions under the National Solar Mission resulting in all time low tariff of Rs. 4.34 per KWh.

The Survey points out that the complexity of the tariff structure because of different tarriffs for different sectors prevents economic actors from responding sufficiently to price signals. Simplification in tariffs may improve transparency and yield consumption and collection efficiency along with governance benefits.

Further, the Survey states that the debt overhang of discoms has traditionally been a major bottleneck for the power sector. The States with highest losses are those where tariffs fail to cover the costs of electricity supply. Several states are now attempting to close this gap under the UDAY scheme.

Power sector’s impact on Make in India

The Economic Survey notes that the electricity supply and its quality impacts industrial output. The electricity tariffs are unusually high for Indian industry, especially when quality is taken into account. The use of diesel generators in on the rise to protect against uneven power supply with total capacity around 72 GW and growing at the rate of 5 GW per year. High tariffs and erratic supply have led to a slow but steady decline in the growth of industrial electricity purchases from utilities and a gradual transition towards captive generation.

The compund annual growth rate (CAGR) of captive power generation between 2006-07 and 2014-15 is 9.3% compared to 4.6% for electricity procured from utilities. This could be exacerbated in the coming years as decline in oil prices and costs of renewable energy alternatives may prompt a further shift to captive power.

Need of making India "One Market in Power" - Providing Open Access

The Survey states that steps have been taken towards ”Making One India” in the power sector. The Open Access (OA) policy introduced under the Electricity Act 2003, which allows consumers with electricity load above 1 MW to procure electricity directly from electricity markets was the first step towards discovering a single market price for power around the country.

Power Exchanges were set up in 2008 to operationalize the OA policy and create a national electricity market where price discovery occurs through competitive bidding. Increases in subsidy and additional surcharges for purchasing electricity from power exchanges, have acted as significant barriers, though they are key to balancing DISCOMS.

The power generation capacity has increased while the financial ability of discoms to purchase electricity has diminished. This has resulted in current power plant load factors reaching their lowest mark at around 60% as The Survey notes that the time is ripe to allow industries with higher power demands to absorb excess generation capacity through “Open Access” to energize “Make in India”.

Progressive tariff rates to reduce burden on the poor

The Economic Survey says that India’s domestic power tariff schedules have greater scope for progressivity. It discusses the need to balance greater revenue collection with greater welfare allocations. It suggests that the tariffs for the poor can be reduced while covering costs and without unduly burdening those better off.

Cross-subsidization will occur within the residential consumers itself - i.e. rich consumers with high consumption intensity within the residential sectors subsidize prices for consumers with lower consumption due to differential demand price elasticity

RFP invited by Jharkhand Renewable Energy Development Agency (JREDA) for setting up 1200 MW Solar Power Project:

Events Date:-

(1) Notice for Request for Proposal (RFP)

04.12.2015

(2) Period of downloading of bidding documents

From 07.12.2015 at 12:00 Noon till 10.01.2016 at 05:00 PM

(3) Response/Clarification on RFP

From 07.12.2015 at 12:00 Noon till 14.12.2015 at 05:00 PM

(4) Pre-bid Meeting 15.12.2015 at 11:30 Hrs. at Hotel Chankya BNR, Ranchi

(5)Clarifications to be issued on RFP and issue of revised RFP (if req.) 18.12.2015

(6)Online Bid Submission along with submission of hard copy of DD/BG

From 19.12.2015 at 11:00 AM till 11.01.2016 upto 05:00 PM. Hard copy submission allowed on 08.01.2016, 09.01.2016 & 11.01.2016

(7) Technical Bid Opening Date 12.01.2016 at 03:30 PM

(8) Technical Evaluation of Bids received in response to RFP

Within 7 days from Technical Bid Opening Date

(9) Approval of Bid Evaluation Committee for opening of Financial Part of RFP Within 10 days from Technical Bid Opening Date

(10) Opening of Financial Part of RFP Within 15 days from Technical Bid Opening Date

(11) Issue of letter of Intent (LoI) Within 15 days from opening of the price part of proposals

(12) PPA Signing Within 15 days from the date of issue of Letter of intent (LoI date + 15 days)

(13) Financial closure of the project Within 210 days from the date of signing of PPA 13 Commissioning of Solar PV Plant

(14) month for Cat. I projects / 18 months for Cat. II projects from the date of signing of the PPA

(1) 200 MW-: Minimum: 1 MW Maximum: 25 MW Project to be in multiples of 1 MW

(2) 1000 MW-: Minimum: 26 MW Maximum: 500 MW Project to be in multiples of 1 MW

(a.) Rs. 25,000/-towards the cost of tender document

(b.) Rs.10,000/ - per MW as bid processing fee

Earnest Money Deposit (EMD) @ Rs. 10 Lacs / MW shall be submitted for each Project in the form of a Bank Guarantee in the favour of JREDA along with Bid as per Format - 6.3A. (valid for a period of 210 days from the last date of submission of the Bid)

Performance Bank Guarantee (PBG) @ Rs. 30 Lacs/ MW shall be submitted for each Project in the form of 03 Nos. of Bank Guarantees in the ratio of 20%, 40% & 40% of the total value in the favourof JBVNL at the time of signing of PPA as per Format – 6.3B. (valid for a period of 18 months for Category – I Projects and 23 months for Category – II Projects from the date of signing of PPA) (Example - If Performance Guarantee value is Rs.4.00 Cr. then 03 BGs of value Rs.0.80Cr, Rs.1.60 Cr & Rs.1.60 Cr are to be submitted)

Private sector to light up a third of households without access to the grid by 2020:

The off-grid lighting and household electrification sector will help light up close to 100 million homes by 2020,according to market trends presented at the 4th International Off-Grid Lighting Association (GOGLA) and the World Bank Group (WBG), in Dubai, UAE.The event showcased global efforts to improve energy access for those without reliable,grid-based electricity by promoting clean, quality off-grid lighting solutions.To date, the industry has helped customers save around $3 billion in outgoings such as kerosene and batteries, according to WBG and GOGLA-collected data presented at the event since the first conference in Ghana in 2008, when the industry was just taking off, more than 15 million solar lighting and electrification products have been sold, reaching 66 million people.

Findings from a Bloomberg New Energy Finance report, due for release in Janauary 2016, also highlight how investors have taken note and pumped almost a quarter of billion dollars into the sector in the past two years alone, with emerging pay-as-you-go business models gaining particular traction.

The Government of India has set an ambitious target of generating over 150 gigawatts of renewable energy by 2022, warranting investments of over US$150 billion.Realization of this target calls for the rapid creation of a positive enabling environment for investors and enterpreneurs alike. In the next few years, we anticipate considerable opportunities around off-grid as well as grid-ready decentralized renewable energy in India.There has been strong indication from across the world that investment in renewable is yielding higher returns on investment. There is also a marked improvement in risk perception around renewable energy projects. Coupled with the emerging clean tech market in India, these aspects offer investors compelling motivation for venturing into renewable energy financing. This report is based on a study of off-grid business models in India by The Climate Group, produced in partnership with Goldman Sachs Center for Environmental Markets, which aims to inform investment and financing decisions on decentralized, distributed renewable energy. It offers first-hand information on some of the most viable, scalable business models that are investment ready. It answers key questions for investors ranging from analysis of sound business models to future prospects and regulatory frameworks in India. The report also consolidates the findings and objectives of The Climate Group's Bijli-clean Energy for All program, which is funded by the Dutch Postcode Lottery.

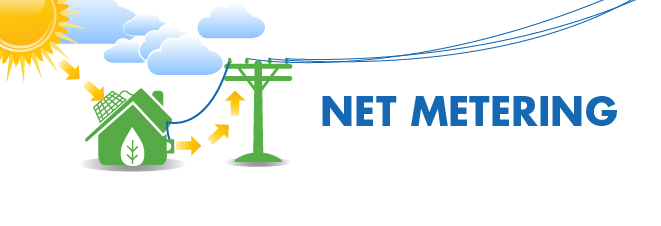

BERC Announces Net-metering Regulations:

After long waiting, BERC net-metering policy is finally in place. Now premises with solar rooftop systems, will be able to supply excess solar energy to the grid through low/high tension power lines through which they are availing power from distribution company. This will earn them energy credits/uints, which can be adjusted against their electricity bills. On July 6, 2015, Bihar Electricity Regulatory Commission (BERC) notified through Bihar Gazette the “Roof Top Solar Grid Interactive Systems based on Net Metering Regulations 2015”.

• The systems to be installed under the regulation shall be of min. 1kWp capacity and Max. 1Mwp cap. However the yearly target capacity of 10MW has been fixed in the area of the distribution licensee.

• The Discom shall offer the provision of Net Metering to the consumer who intends to install rooftop systems on first come first serve basis.

• A max. cumulative capacity at a particular distribution transformer shall not exceed 15% of the peak capacity of the distribution transformer.

• The capacity of an individual rooftop PV system would be equal to the sanctioned load of the consumer.

• The energy accounting and settlement will be done based on the reading of the bidirectional meters.

• Any energy credits of a consumer from previous months will be carried to next billing period and will be set to zero after the settlement period.

• The electricity generated from a solar rooftop systems shall not be more than 90% of the total energy consumption of any consumer in a settlement period. No payment shall be made by the distribution licensee, beyond this limit.

• The quantum of energy consumed from the rooftop system will be considered towards the Renewable Purchase Obligation (RPO) of Distribution licensee if the consumer is not an obligated entity.

• Such rooftop systems shall be exempted from payment of wheeling, banking and cross subsidy surcharge if under Open Access mode.

• The eligibility for availing benefits of REC mechanism shall be as per CERC REC Regulation 2010.

General conditions: Connectivity of the distribution network to renewable energy systems will be provided on a first come first serve basis and will be subject to several constraints including available capacity at a particular distribution transformer and the sanctioned load of the consumer of the premises. In case the capacity of renewable energy system is greater than the sanctioned load for the premises, the consumer of the premises will have to expand their sanctioned load. The minimum capacity of the renewable energy system is 1 kWp.

Metering arrangement: Net meter or a pair of meters will have to be installed at the premises. The renewable energy meter for accounting the energy produced and the net meter for accounting the net import/export of energy by the consumer. The cost for procuring, testing and installing the net meters will be borne by the consumer of the premises whereas that of the renewable energy meter will be borne by the distribution licensee.

Billing and energy accounting: The energy exported to the grid by the consumers during a billing cycle will be adjusted in the consumer’s bill for that billing cycle. In case the energy exported is more than that consumed, the surplus units will be carried forward to the next billing period. There will be energy accounting for each FY and no carried forward is allowed after the end of FY. Under net metering various charges like wheeling, banking and cross subsidy charges have been waived.

With around 250-300 sunny days and an average isolation of 5 units per day per kWh rooftop solar can be expected.

- See more at: http://www.pragnyaurja.com

PACEsetter Fund (Early stage grant funding to accelerate the commercialization of innovative off-grid clean energy products,system and business models):

A Fund to support the "Promoting Energy Access through Clean Energy"(PEACE) track of the U.S.-INDIA partnership to Advance Clean Energy (PACE)

The mission of the PACEsetter fund is to accelerate the commercialization of innovative off-grid clean energy solutions by providing early-stage grant funding that would allow businesses to develop and test innovative products, business models and systems.

On August 19 in New Delhi, Secretary Upendra Tripathy of the Ministry of New and Renewable Energy joined with U.S. Ambassador to India Richard Verma to announce the first round of grant funding through the PACEsetter Fund. The fund is part of PEACE, Promoting Energy Access through Clean Energy (http://newdelhi.usembassy.gov/pr110314.html). The program makes up to $8 million in grants available for innovative, early-stage off-grid clean energy projects.

The goal of the PACEsetter Fund is to improve the commercial viability of small-scale clean energy projects throughout India. Solutions may come in many forms such as a policy recommendation, a software suite, a hardware innovation, a training program or a new revenue generation model. The PACEsetter Fund is looking for fresh approaches and new ideas.

If you have an idea or know someone who does, please visit www.pacesetterfund.org for more details. Interested parties still have plenty of time to fill out an Expression of Interest form and submit it for consideration.

Nearly 275 MW Rooftop Solar Potential in Patna:

Greenpeace and Bridge to India has estimated potential of nearly 275 MW Roof Solar potential in Patna.

"Bridge to India's comprehensive analysis of the current power scenario of the state concludes that, in the long run, a large-scale adoption of solar power in Patna can be a key building block to an affordable and reliable power supply.

"Bridge to India's modelling revealed Patna has the geographical potential to install around 759 MW of rooftop solar. This is twice the current India-wide installed rooftop solar capacity.

"The solar rooftop market is a great opportunity for companies and investors, offering innovative sales, operations and financing solutions. Analysts at Bridge to India have envisaged a roadmap for Patna to help meet its energy demands by adopting solar in a phased manner.

"The city could add 275 MW by 2025 without significant technical challenges, storage requirements or dedicated grid investments. Thus, solar could meet about 20 per cent of the city's power requirement."

Patna could start producing up to 35 MW of solar energy in the initial phase by using the roof space on government and industrial buildings.

"The Solar Rooftop revolution for Patna is not just a report but a vision to realize Patna as a green capital powered by clean and sustainable sources of energy like solar," said CEED programme co-ordinator, Akanksha Upadhyay, "This report comes at a time when the new draft of urban development policy recognizes the programme for solar rooftop projects.

Government buildings are key

Significantly, government buildings, due to their proximity to each other and large roof space, facilitate a bundling of projects that can enable larger project sizes.Large solar systems reduce the per-kW cost considerably, making solar already viable for government buildings. Hence, there is clear viability for solar power in Patna without long-term capital subsidies, as the scenarios in the report illustrate.

IREDA’s scheme will provide loans at interest rates between 9.9% and 10.7% with a repayment period of nine years:

Power minister Piyush Goyal on Tuesday launched the Indian Renewable Energy Development Agency (IREDA)’s loan scheme for rooftop solar power projects in the country. The scheme will provide loans at interest rates between 9.9% and 10.7% with a repayment period of nine years.

“The loan can be availed by project aggregators, developers for a minimum aggregated project size of 1MW (megawatt) and sub size of 20KW (kilowatts),” said Tarun Kapoor, joint secretary, ministry of new and renewable energy. The scheme has been formed by drawing credit lines from German development bank KfW and Japan International Cooperation Agency. “They will be tax-free bonds, which IREDA will float shortly,” Kapoor added.

The government is also looking at making amendments to the Electricity Act, 2003, for strong enforcement of the Renewable Purchase Obligation (RPO) and for providing Renewable Generation Obligation (RGO). In addition, stringent penalties for violations are being proposed. “I am told that the tariff policy and amendment in the act is more or less ready and it will soon go to the cabinet,” said cabinet secretary Pradeep Kumar Sinha.

RPOs are the minimum percentages of the total power that electricity distribution companies and some large power consumers need to purchase from renewable energy sources. RGO means that for every new thermal power station that is set up in the country, firms will also have to set up a percentage of renewable capacity.

Of the total 100,000MW solar power capacity planned, 20,000MW will come from solar parks and 40,000MW each from rooftop and distributed generation projects.

An earlier target to install 20,000MW of solar energy capacity by 2022 was raised fivefold to 100,000MW. Renewable energy, at present, accounts for only 35,777MW of India’s total power generation capacity of 272,503MW.

The National Democratic Alliance government, which has made enhancing power generation a key policy priority, is looking to supply adequate power at affordable prices. The aim is to double electricity generation to two trillion units by 2019.

Indiagosolar rolls out first ever online ecosystem for Indian Solar Industry

Date:20 Sep, 2016

New Delhi: India's first ever e-info marketplace Indiagosolar rolls out its comprehensive service offerings, starting with basic information, consultancy to project execution and post implementation service across institutional and retail customers.

The company provides a unique platform that offers information, technical advisory services and multiple options to buy and sell solar products and services online.

IndiaGoSolar also facilitates financing through banking partners, government

subsidies, and loans available to customers, while purchasing a solar product or solution, thereby bringing complete transparency on each transaction.

The platform also helps buyers identify the right solar products, projects and services best suited to their needs and make all relevant technical and commercial information available to support buyers making a prudent purchasing decision.

The company also puts in a lot of effort to raise the quality standards of existing solar products and services available in the market and reduce customer's worries related to technology, warranties, financing, transportation, installation and after sales service and repair of solar products and systems.

Indiagosolar lists only those integrators, EPC and manufacturers on their platform which are already empanelled by MNRE and state agencies. To ensure authenticity and credibility, each of these companies go through a systematic process of scrutiny before they become channel partners or system integrators.

All other smaller and motivated solar players can become IGS affiliates. Applicants are checked thoroughly before they can find affiliation on Indiagosolar in order to market and install products and services.

"Indian customers should have the choice to choose its own electricity supplier and if they can own their source of electricity generation on their roof, it is much better. Once the Government laid down the ambitious goal to set up 40 GWs solar roof top capacity," said Founder and CEO Indiagosolar, Dr. Harish Ahuja.

"We decided to build a marketplace to allow people to freely buy and sell solar products and services online. Unlike older times, the solar industry in India has now evolved, driven by industry landscape, competition, fast evolving technology and ever decreasing cost," added Dr. Harish Ahuja.

"This is where our online marketplace can provide the right information and advisory on solar product technology, multiple suppliers, real-time price comparison, economic and commercial benefits, and options of purchasing standardized projects and delivery and installations. Besides, helping customers to find the right financing partner and facilitate the transaction online," added Ahuja.

The key offerings of Indiagosolar includes an exclusive range of innovative, best-of-breed solar products and services, hosts several EPC players and suppliers and facilitates 24X7 shopping from anywhere, anytime, across India.

From a humble beginning with 1 solar product supplier on board to presently having more than 42 manufacturers, 20 EPC players, 10 financial consultants, the company has been able to chart a high octane growth path, considering the constraints and inhibitions the industry faces regarding buying and selling of solar products and services online.

Some of the initial road-blocks that the brand faced in its early days pertain to Government's over-interference in the sector, regulatory delays on net-metering policy, unavailability of industry accepted standards for solar products and end-consumers inhibitions of adopting solar as an alternative source of energy.

Currently the company has a foot-print all across India supported by a well-entrenched partner and affiliate network and tie ups with six to seven major PSU banks.